Category: Forex MT5 Indicators

The best MT5 indicators are waiting for you. Take your trading to next level and explore the industry’s top MT5 indicators. And the best part? All these MT5 indicators are free to download.

Fibonacci Arc Indicator

The Fibonacci Arc Indicator for MT5 plotts dynamic curved lines that traders can utilize as price channel or even as support/resistence levels. The formula behind this tool includes Fibonacci-based calculations. Let’s check some effective ways to introduce it to real trading – golden ratio strategies always provide interesting prospects. We’ll explore few approaches to find […]

Breakout Bars Trend Indicator

The Breakout Bars Trend Indicator for MT5 simply colorizes candlesticks directly on the chart in order to provide market trend-momentum with a quick glance. This is a great way to reduce clutter in your technical analysis and improve confidence of the trading decisions. You can consider it as an alternative to moving averages that help […]

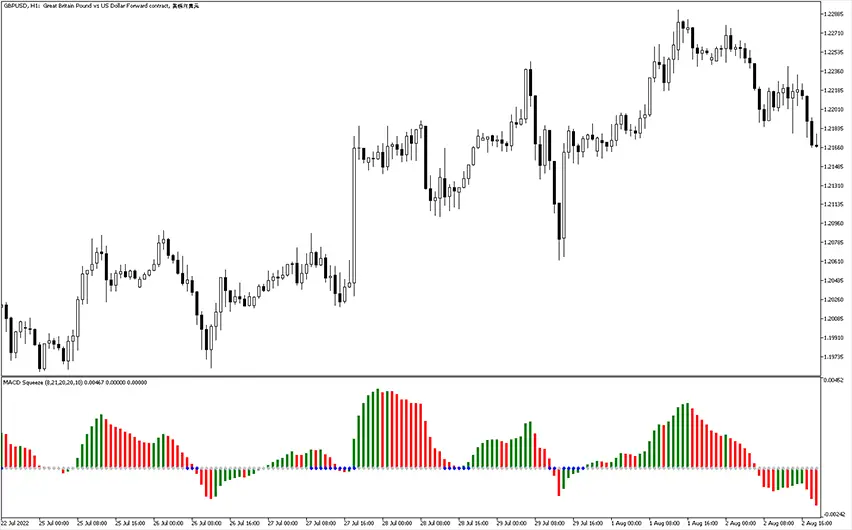

MACD Squeeze Indicator

The MACD Squeeze Indicator represents a special squeeze technique based on three core elements. While signals provided by this gauge are displayed as a simple histogram, in essence, there is a more complex formula behind the scenes. Let’s take a look in more details. MACD squeeze strategy in MT5 So, the main elements that consists […]

Stochastic Cross Alert Indicator

The Stochastic Cross Alert Indicator for MT5 is a technical trading tool that simply utilizes crossovers of signal lines from the renowned Stochastic gauge. It conveniently displays buy and sell arrows directly on the price chart for immediate visual reference. This user-friendly approach ensures that trader with any level of exeprience can quickly reap its […]

Nduet Semaphore Trend Momentum Indicator

The Nduet Semaphore Trend Momentum Indicator for MT5 is actually a combination of two Moving Averages and the Semaphore gauge. The goal of the moving averages is to determine the trend’s direction and the Semaphore alert indicator serves as identificator of the momentum. Let’s check if this combo is really useful. Trading with the trend […]

ADR Indicator MT5

The ADR (Average Daily Range) Indicator MT5 is a powerful tool in forex trading that provides valuable insights into the expected market range. The indicator serves as a reliable reference point for determining both support and resistance levels. By analyzing historical price movements, the ADR indicator helps traders identify potential breakout and reversal opportunities, making […]

SSL Channel Chart Indicator

The SSL Channel Chart Indicator for MT5 combines moving averages to generate trading signals. The acronym SSL stands for Semaphore Signal Level, and it offers visual indications for buy/sell signals. It presents signals for both bullish and bearish trends when the lines of the indicator cross. Free download is available at the bottom. Let’s have […]

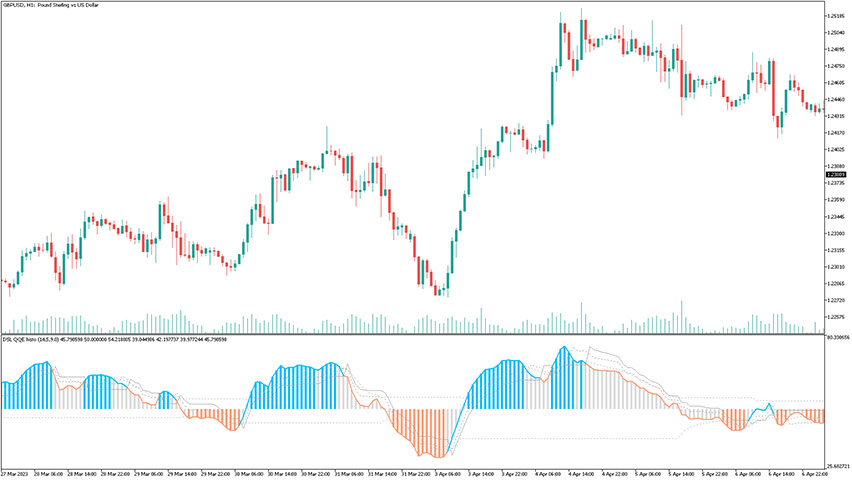

QQE Histogram Indicator

The QQE Histogram Indicator for MT5 is an enhanced version of the QQE technical indicator, but it has several interesting features added. This tool introduces discontinued signal line levels to provide more insights into the trend. What’s more, it also includes color-changing histogram bars that correspond to these mentioned levels. As always, free download is […]

Pattern Recognition Indicator

The Pattern Recognition Indicator for MT5 is forex tool designed to detect and display candlestick patterns on your charts as soon as they emerge. This indicator is specifically developed to automatically identify and highlight candlestick patterns in real-time on your trading charts. Free download is available. When it’s activated, your chart should look more less […]

Keltner Channel Oscillator Indicator MT5

The Keltner Channel Oscillator Indicator MT5 is a revised edition of the Keltner Channel indicator, created to simplify the recognition of channel breakouts. By utilizing this oscillator, it becomes effortless to spot characteristics and patterns in the price movement that would otherwise be challenging to discern without any aid. From a technical perspective, both versions […]