Guppy Multiple Moving Averages Indicator

Platform: MT4 Type: Trend Last update: October 16, 2024The Guppy Multiple Moving Averages (GMMA) Indicator for MT4 is a forex technical indicator that exploits moving average ribbons in the context of potential price breakouts of a currency pair. It was originally introduced by an Australian trader named Daryl Guppy, hence, the name of that tool. There are 13 Exponential Moving Averages (EMAs) to identify the market trends. Their arrangement can show a developing trend or a reversal in the making.

This a trading tool that’s definitely worth getting familiar with, so let’s take a closer look at it and bring some practical trading examples.

Introducing the Guppy Multiple Moving Averages

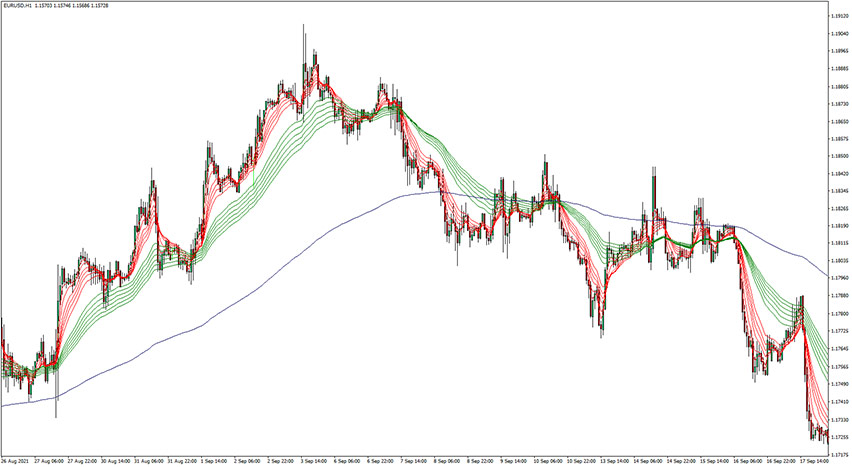

This is how it looks upon activation:

As you can see, that forex indicator consists of 12 Exponential Moving Averages plus we have added one blue 200-period EMA reflecting a long-term view of the trend. It utilizes multiple lines which allow traders to gain a better understanding of the strength or weakness of a trend, as opposed to using only one or two EMAs.

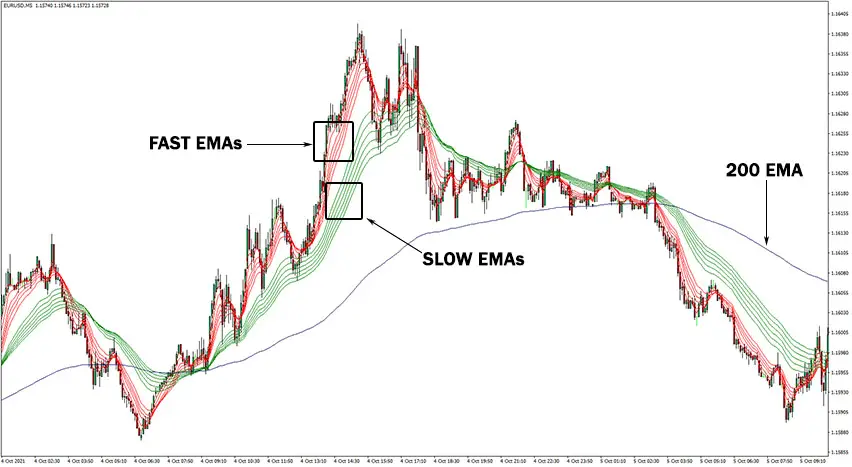

Two groups of moving averages can be distinguished, namely:

- Fast MAs (red lines)

- Slow MAs (green lines)

Each group has six moving averages. The lines in red color represent 3, 5, 8, 10, 12, and 15 EMAs, while the green lines portray 30, 35, 40, 45, 50, and 55 periods.

When the fast EMAs cross above the slow EMAs, it indicates a bullish trend in the market. To further confirm this trend, it is important to ensure that all moving averages are above the 200-EMA. On the other hand, in the time of a bearish market trend, the fast EMAs will fall below the slow EMAs, and all moving averages will be positioned below the 200-EMA level.

Additionally, the 200-EMA can serve as a reliable long-term level of support or resistance for the price.

How can one differentiate between a strong trend and a weak one?

The Guppy Multiple Moving Average is a tool that can be used to detect shifts in trend direction or measure the intensity of the present trend. The distance between the short-term and long-term moving averages can serve as an indication of how strong the trend is.

When there is a large gap between the short-term and long-term moving averages, it suggests that the current trend is robust. On the other hand, when the gap is small or the lines are intertwined, it indicates that the trend is losing momentum or the market is consolidating.

How to trade with the guppy multiple moving averages indicator?

It’s a versatile trading tool and one can apply a lot of various trading strategies, from trend-following to reversal. We are going to introduce a pullback trading in the direction of an overall trend. Let’s deep dive into how to exactly use that forex indicator in a few easy steps.

Buy Signal

- Group of Fast EMAs move above group of slow EMAs

- Both groups are positioned above 200 EMA

- Distance between these two groups is big enough

- Fast group makes a pullback to slow group

- Eventually fast group makes a reversal in the original direction

- Set stop loss a few pips below the 55 EMA

- Take profit when price drops below the fast group

Sell Signal

- Group of Fast EMAs move below group of slow EMAs

- Both groups are positioned below 200 EMA

- Distance between these two groups is big enough

- Fast group makes a pullback to slow group

- Eventually fast group makes a reversal in the original direction

- Set stop loss a few pips above the 55 EMA

- Take profit when price rises above the fast group

Conclusion

Success in trend trading relies not only on correctly identifying the trend direction and entering the market at the right time, but also on exiting the market promptly once the trend has reversed. If you are experiencing difficulty with any of these aspects, it may be helpful to consider using the Guppy Multiple Moving Average indicator.

Submit your review | |