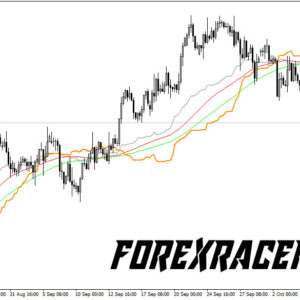

RSI High-Low Forex Trading System

Trading SystemsStrategy overview

Currency pairs: any, but majors recommended

Timeframe: any

Indicator: standard RSI (14) with levels at 70 and 30

(Relative Strenght Index comes with your Metatrader by default, there is no need to download it).

How to trade with RSI High-Low Strategy?

Buy signal: open long trade when RSI has crossed below 30, formed a bottom, and then crossed back up through 30 level.

Sell signal: open short trade when RSI has crossed above 70, formed a peak, and then crossed back down through 70 level.

Exit: close the trade when RSI reach opposite level (if you sell close it at 30, if you buy close it at 70).

Strong sides: RSI is a great technical indicator commonly used for trade entry confirmation in both simple and complex trading systems. For current strategy it generetes good entries, but profitable trades occurs much often when you follow main trend.

Weak sides: there may still some false signals take place from time to time. We highly recommend to use RSI High-Low strategy in combination with other filtering indicators.