Stochastic Cross Alert Indicator MT4

MT4 Free DownloadIntroduction to the Stochastic Cross Alert Indicator

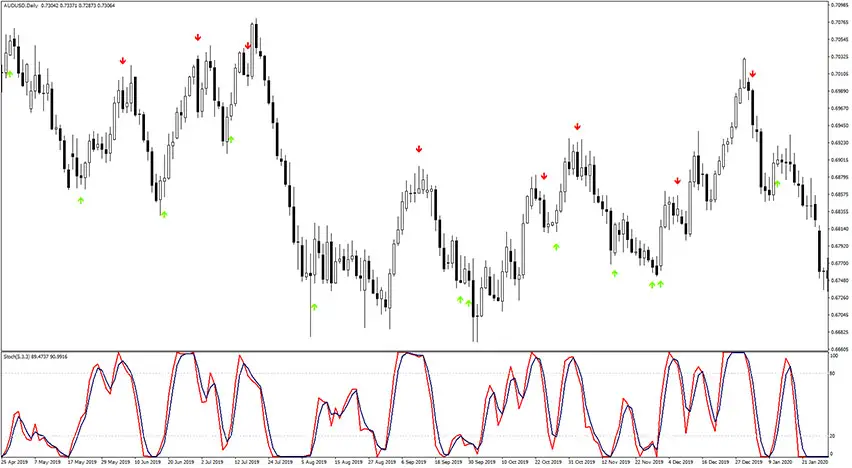

The Stochastic Cross Alert Indicator is, as the name suggests, based on a popular technical indicator of the family of the oscillators. The oscillators define when the market is overbought and oversold. That gauge isn’t an exception, but it provides signal alarms in the form of buy/sell arrows, which is a favorite way of many traders.

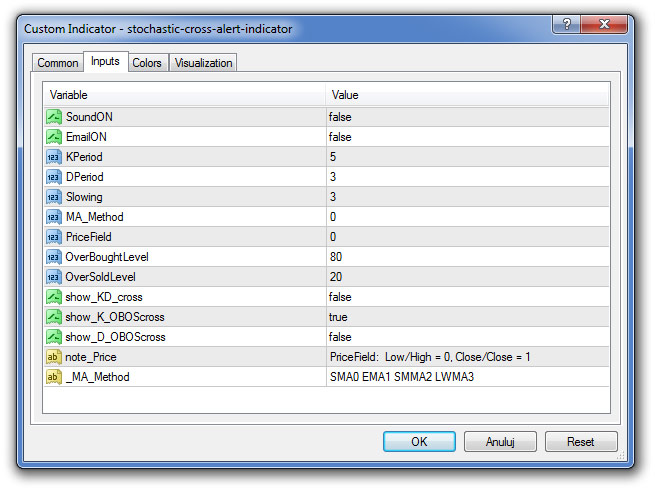

The Stochastic Cross Alert Indicator fits all kinds of timeframes and currency pairs. It is displayed directly on the main trading chart. The default settings can be modified directly from the input tab. Feel free to experiment with the settings and parameters to fit your personal preferences.

Anatomy of the Stochastic Cross Alert indicator

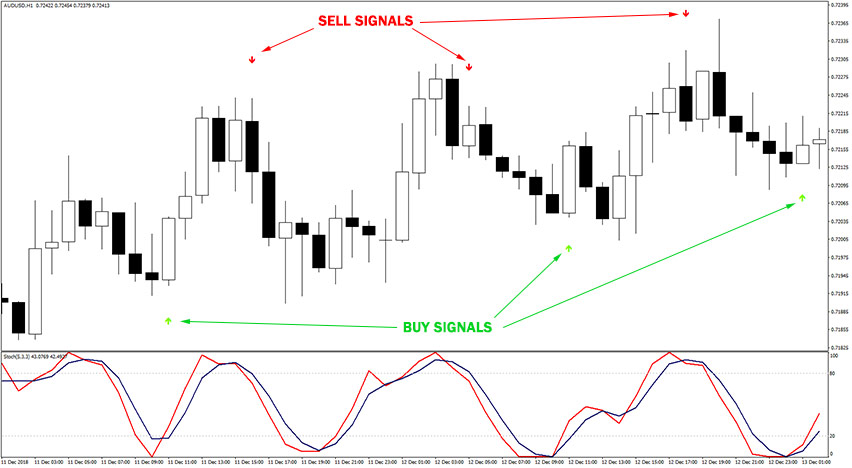

The Stochastic Cross Alert Indicator does all the necessary calculations in the background and gives the signals by plotting simple upward/downward arrows around the price candlesticks. For a long trade, it draws a buy arrow on the chart when the indicator lines cross each other from below 20 level back above (oversold readings). Similarly, a short trade is triggered when a red sell arrow appears on the chart and the lines cross each other from above 80 level back below (overbought readings). Due to the nature of the indicator, it works well during sideways markets and performs poorly during strong trends.

If you prefer to customize the settings, take a look at these features:

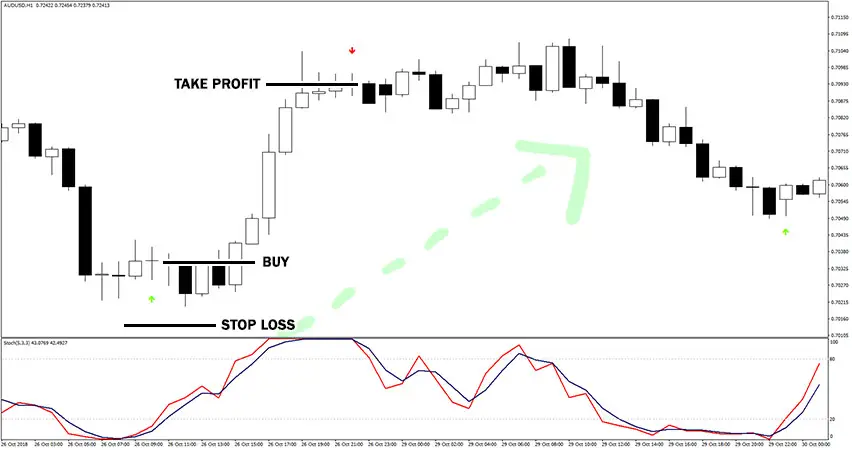

Stochastic Cross Alert Indicator: Buy Signal

Follow these steps for a long trade:

- There is a range market

- A green upward arrow is plotted

- Buy trade is triggered after candle close

- Set stop loss a few pips below the most recent market low

- Take profit when opposite arrow apperas

Stochastic Cross Alert Indicator: Sell Signal

Follow these steps for a short trade:

- There is a range market

- A red downward arrow is plotted

- Sell trade is triggered after candle close

- Set stop loss a few pips above the most recent market high

- Take profit when opposite arrow apperas

How to set up the Stochastic Cross Alert indicator in MetaTrader (MT4)?

Installation Guide

Download the Stochastic Cross Alert.rar archive at the bottom of this post, unpack it, then copy and paste the Stochastic Cross Alert.ex4 or Stochastic Cross Alert.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Summary Of That Forex Indicator

The Stochastic Cross Alert indicator is well worth adding to your trading collection. A good forex indicator will most probably enhance your chance of success. Nonetheless, remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time. Thus, this forex indicator provides false signals occasionally. Its performance will vary significantly depending on market conditions. Feel free to develop your own trading system based around it. Don’t forget that we still have more great free forex MT4 indicators to download and try.

Download Free Forex MT4 Stochastic Cross Alert Indicator

To download the Stochastic Cross Alert Indicator for Metatrader 4 (MT4) for free just click the button below:

Stochastic Cross Alert Indicator Free Download