Double Stochastic With RSI Indicator MT5

MT5 Oscillator TradingFree DownloadThe Double Stochastic With RSI Indicator MT5 (MetaTrader 5) is a powerful tool that merges the RSI and Stochastic oscillators, two renowned forex indicators known for their effectiveness in reversal trading. By amalgamating these two indicators, it provides a comprehensive view of market dynamics. Its primary function is to detect overbought and oversold market conditions, accurately presenting them on the price chart. This forex MT5 indicator is available for free download.

Double Stochastic With RSI Indicator MT5: Introduction

MT5 Indicator Overview

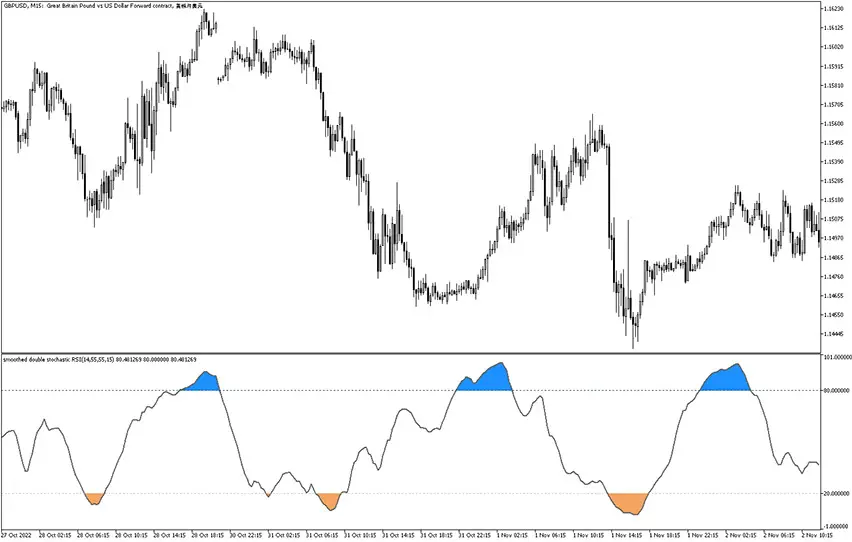

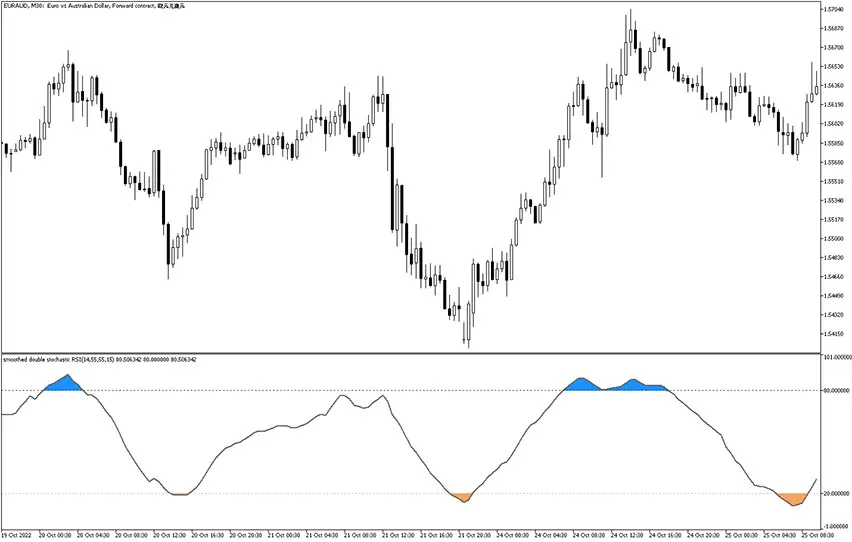

The download link of the Double Stochastic With RSI MT5 indicator is placed at the bottom of this post – once you’re done, your Metatrader 5 trading chart should look similar to the example below.

The Double Stochastic RSI Indicator combines the Stochastic Oscillator and the Relative Strength Index (RSI) to create a momentum indicator with the primary purpose of identifying overbought and oversold markets and potential reversal signals.

As an oscillator-type technical indicator, it generates a line that oscillates within the range of zero to 100, accompanied by dashed lines at levels 20 and 80. A region below 20 signifies an oversold area, while an area above 80 indicates an overbought zone.

When the indicator’s line drops below 20, it detects an oversold market and visually represents it by shading the area in orange. Conversely, breaching above 80 signifies an overbought market, and the indicator shades the area in blue to highlight this condition.

Formula Behind The Double Stochastic With RSI

The Double Stochastic RSI Indicator employs a sophisticated algorithm that combines the underlying RSI with a formula akin to that of the Stochastic Oscillator. This process yields a specific value, which is subsequently plotted as a point on the single oscillator line.

Additionally, the indicator continuously monitors the position of the line value relative to the levels 20 and 80. As we already mentioned, whenever the line value falls below 20, or rises above 80, the indicator promptly identifies these conditions and visually represents them by shading the corresponding area on the chart.

Simplified Trading Suggestions

- For a buy trade, focus on the overall upward trend, and consider opening a position when the price retraces and chart displays the orange area (indicating oversold conditions).

- For a sell trade, observe the general downward trend, and consider initiating a trade when the price rertaces and chart shows the blue area (signaling overbought conditions).

MT5 Indicators: Download and Installation Instructions

Download the Double Stochastic With RSI Indicator MT5.rar archive at the bottom of this post, unpack it, then copy and paste the double-stochastic-rsi.ex5 or double-stochastic-rsi.mq5 indicator files into the MQL5 folder of the Metatrader 5 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL5 > Indicators (paste here).

Now go to the left side of your MT5 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Indicator Summary

The MT5 Double Stochastic With RSI indicator for MetaTrader serves as a powerful mean reversal indicator, offering valuable insights for forex traders. While not infallible, its reversal signals carry a remarkably high probability of leading to actual mean reversals. Moreover, these signals tend to align with mid-term trends, providing the opportunity for more substantial gains on successful trades. The forex indicator is available for free download and can be effortlessly installed.

Free Download Forex Double Stochastic With RSI MT5 Indicator

To download the Double Stochastic With RSI Indicator for Metatrader 5 (MT5) for free just click the button below:

Double Stochastic With RSI Indicator Free Download