Stochastic Momentum Index (SMI) Indicator MT4

MT4 Free DownloadIntroduction to the Stochastic Momentum Index Indicator

The Stochastic Momentum Index Indicator is a technical analysis gauge that analyzes price momentum. Its calculations are based on the closing price relative to the median range (high-low) of the currency pair price over a specified period. The SMI indicator is considered an improved version of the standard Stochastic Oscillator.

The Stochastic Momentum Index Indicator fits all kinds of timeframes and currency pairs. It is displayed in a separate window placed just below the main trading chart. The default settings can be modified directly from the input tab. Feel free to experiment with the settings and parameters to fit your personal preferences.

Closer look on the Stochastic Momentum Index Indicator

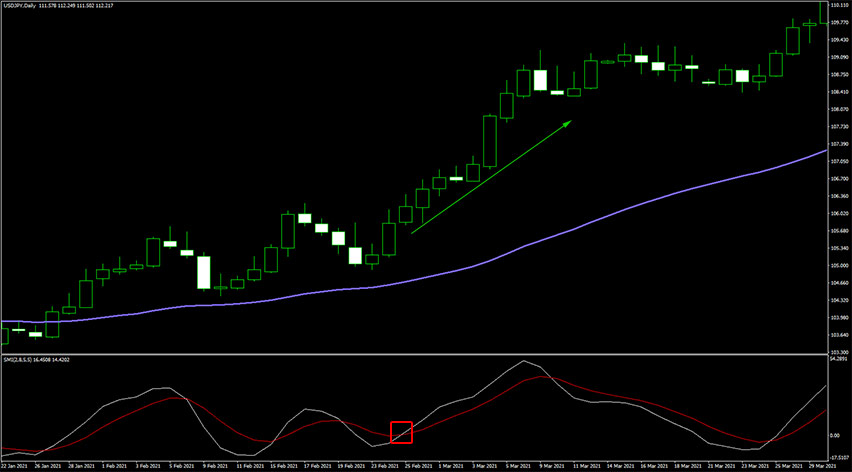

As we already mentioned, the Stochastic Momentum Index uses the mid-range prices between the High and Low, while the stochastic oscillator is based on the closing prices, thus making the provided signals of SMI more reliable and responsive. If you are not familiar with technical jargon, just take a look at the chart with SMI active on it:

Traders can use the indicator on two occasions:

- Crossover of the SMI lines.

- Divergence between the price and SMI.

These are customizable input available in the settings window:

Buy Signal

In the example below, you can see an example of a buy trade, when the Stochastic Momentum Index indicator is used in conjunction with the 50-period Exponential Moving Average. The MA defines a bullish trend (the price stays above the line), and the trade is triggered on the SMI crossover.

Sell Signal

In the example below, you can see an example of a sell trade, when the Stochastic Momentum Index indicator is used in conjunction with the 50-period Exponential Moving Average. The MA defines a bearish trend (the price stays below the line), and the trade is triggered on the SMI crossover.

How to set up the Stochastic Momentum Index indicator in MetaTrader (MT4)?

Installation Guide

Download the Stochastic Momentum Index.rar archive at the bottom of this post, unpack it, then copy and paste the Stochastic Momentum Index.ex4 or Stochastic Momentum Index.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Summary Of That Forex Indicator

The Stochastic Momentum Index indicator is well worth adding to your trading collection. A good forex indicator will most probably enhance your chance of success. Nonetheless, remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time. Thus, this forex indicator provides false signals occasionally. Its performance will vary significantly depending on market conditions. Feel free to develop your own trading system based around it. Don’t forget that we still have more great free forex MT4 indicators to download and try.

Download Free Forex MT4 Stochastic Momentum Index Indicator

To download the Stochastic Momentum Index Indicator for Metatrader 4 (MT4) for free just click the button below:

Stochastic Momentum Index Indicator Free Download