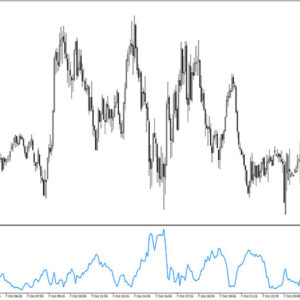

Synthetic VIX Indicator

Platform: MT5 Type: Volatility Last update: October 16, 2024The goal of Synthetic VIX Indicator for MT5 is measuring the increase or decrease of price volatility for given assent. It was originally developed for stock market only including S&P 500 Index, Dow Jones Industrial Average, and NASDAQ Composite Index. This version of course supports the forex market.

Please be aware that this gauge doesn’t provide buy/sell signals, it should be rather used for technical analysis supplement. One of the best use cases is combination with breakout strategies. You should spot the setup of low valtility and sideways movement. Afterwards, you should utilize a breakout when the volality significantly increase and there is a impulse in given direction.

Readings interpretation

The formula uses a 20-period moving average to track changes and the readings are presented within dynamic scale. The interpretation is pretty obvious and when the VIX is placed in lower part of window, it corresponds to low volatility. For the opposite scnario, the signal line is meant to be placed in the upper part.

Submit your review | |