1-2-3 Reversal Points Pattern Indicator

MT4 Pattern TradingFree DownloadThe 1-2-3 Reversal Points Pattern Indicator for MT4 is a nice tool created to find spots with high likelihood of short-term turnaround. Essentially, it’s based on Fibonacci numbers which are known for suprising effectivness in financial markets and other areas. Once a setup is in place, this gauge provides buy/sell arrows directly on chart. They signal potential start of a bullish or bearish reversal. Let’s see how good this is in real-world trading.

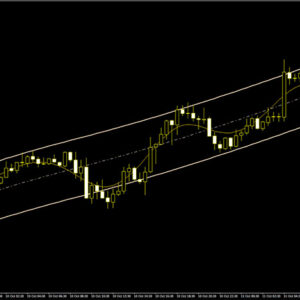

This is how it looks upon activation in your MetaTrader platform.

How does the 1-2-3 pattern actually work?

If you are not familiar with the 1-2-3 pattern, we will explain it in details further, but first let’s examine the example chart above and what can be seen there. When you pay attention, you will notice each of these numbers in small circles.

The most important is third leg. After it’s placed, this system provides an arrow suggesting opening a corresponding trade. But there is a catch – a horizontal line that should be considered a take profit target. On the other hand, stop loss should be put a few pips away from the circle in order to have a safe zone.

You need to measure risk to reward ratio and judge each setup individually. In other words, there must be reasonably significant distance to this target to make it worth.

The formula explained

Here is the overview to grasp the concept behind each point (on bullish case exampe, bearish one is just reversed):

- 1 – the lowest price level in the section

- 2 – the higher low compared to previous point

- 3 – that’s the most recent low point, but it’s higher than price in point one (this is powerful)

Summary

This indicator is based on one of the classic formations and it’s really reliable. The signals generated have very good probability of success. Putting it together with common sense, money managment rules and price action analysis, it can be in the result a great and profitable tool.