ADR Indicator

Platform: MT5 Type: Market Levels Last update: September 21, 2024The ADR (Average Daily Range) Indicator for MT5 is a dedicated tool that caculates and provides expected market range. These boundaries are defined directly on the trading chart and serve as a good reference points – you can think about them in terms of support and resistance levels. They can be very handy in taking advantage of breakout and trend reversal opportunities. And they are one of the best strategies out there. Let’s have a deeper look.

Analysis of the adr indicator

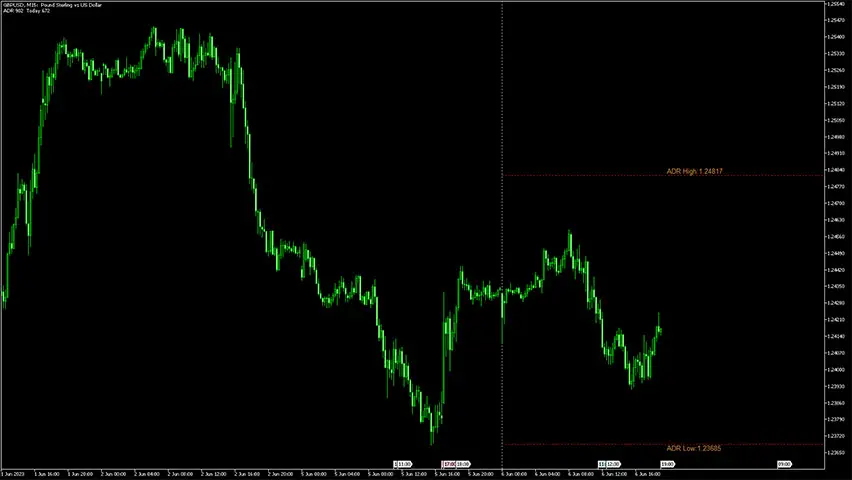

When you load it up and activate in your MetaTrader 5 platform (download for free before), you’ll see something like this.

As you can see, it gathers all the important data of the current day and these essential informations are placed in different parts of the screen. The value is provided in the top left corner, while horizontal lines are aligned with the progressing present-day.

Please note that this gauge is based on past data (by default 14 previous periods) and it automatically adjusts to the volatility. In other words, some days will have a wider ATR, while some will be rather tight. What’s more, each currency pair has it own specifics and volatlity tendencies. It’s wise to account that and have individual look at them.

Trading suggestions

The best approach is watching price action behaviour near the high and low bands. Usually these areas are characterized by change in volume and momentum. Ultimately there can be one of the two outcomes, either a rejection and reversal or breakout and trend continuation.

We advise to stick with one of these strategies and master it. You can onboard additional technical analysis tool to confirm your decisions. Statistically speaking, the price will more likely exhaust near support and resistance zones, thus for many traders reversal would be a better strategy to pick.

By observing price interaction at the top ATR line, you should expect potential short order (sell). Similarly, at the bottom line watch for long setup (buy). Stop loss should be placed in a few pips distance from the trigger line, and take profit targets can be in the middle and at the opposite side.

Conclusion

We think this is an useful forex indicator since it covers several aspects of the market view. It shows high-probability daily extremes, provides entry points, helps to define good and realistic targets with reasonable risks. Feel free to use it incojunction of any additional tool of your choice for further success increment.