Hikkake Pattern Indicator MT4

MT4 Pattern TradingFree DownloadThe Hikkake Pattern Indicator MT4 is a forex technical analysis indicator used for the identification of short-term trends and it’s available for free download. It’s based on the concept of “false breaks” which is typically used by reversal traders. Such an approach is particularly effective during sideways market conditions.

Are you a fan of reversal strategies? If so, let’s take a closer look at it and bring some practical trading examples.

Introducing the Hikkake Pattern Indicator

MT4 Indicator Overview

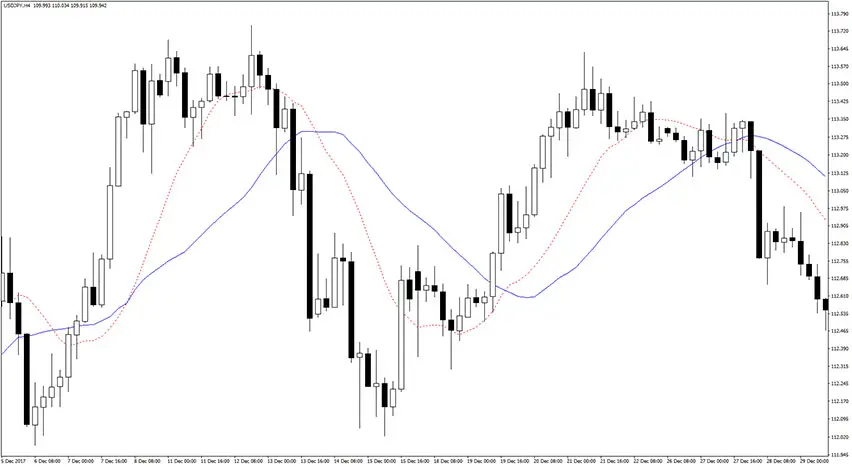

The download link of the Hikkake Pattern MT4 indicator is placed at the bottom of this post. Once you’re done, your trading chart should look similar to the example below.

The general idea behind that forex indicator is that price makes a false breakout from a rangebound, only to quickly reverse and move in the original direction. This action creates a so-called hikkake pattern on the chart and this name means a “trap” in Japanese.

As you can see, it consists of two moving average lines, where one is solid and the second is dotted. During an uptrend, a selling opportunity occurs when the price touches or crosses below the dotted line. Conversely, the price crossing above the dotted line is an indication of a potential buying opportunity. Usually, the profit target is a few candles above or below after crossing the opposite blue line.

An aspect worth paying attention to is the distance between these two lines. The higher the gap, the better. Avoid trading during the very tight alignment of these two.

Settings

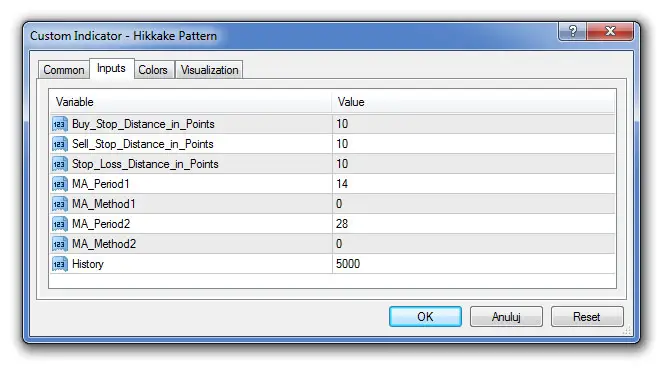

There are quite a few variables you can customize to fit your preferences or your trading strategy.

How To Trade With The Hikkake Pattern Indicator?

Generally speaking, the signal trigger is based on false breakouts and then a real reversal. Let’s deep dive into how to exactly use that forex indicator in a few easy steps.

Hikkake Pattern: Buy Signal

- Dotted line is below the solid line

- Price touches or crosses above the dotted line

- Distance between two lines is big enough

- Open long trade when the above conditions are met

- Set stop loss a few pips below the most recent market’s low point

- Take minimum profit after crossing the solid line, but often the price still rises for a few candles

Hikkake Pattern: Sell Signal

- Dotted line is below the solid line

- Price touches or crosses above the dotted line

- Distance between two lines is big enough

- Open short trade when the above conditions are met

- Set stop loss a few pips above the most recent market’s high point

- Take minimum profit after crossing the solid line, but often the price still falls for a few candles

How to set up the Hikkake Pattern indicator in MetaTrader (MT4)?

Installation Guide

Download the Hikkake Pattern.rar archive at the bottom of this post, unpack it, then copy and paste the HikkakePattern.ex4 or HikkakePattern.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Conclusion

The MT4 Hikkake Pattern indicator is one of the most well-known reversal patterns and it’s definitely worth utilizing in your trading endeavor. It can be applied to any currency pair and time frame, but we suggest using it on intraday charts. We think it’s a good fit for rather knowledgeable traders but after some little training, beginners may succeed too. It would be a good idea to use it in conjunction with some technical analysis forex indicators defining sideways market conditions like MACD Flat Trend Detector.

Download Free Forex Hikkake Pattern MT4 Indicator

To download the Hikkake Pattern Indicator for Metatrader 4 (MT4) for free just click the button below:

Hikkake Pattern Indicator Free Download