Stochastic RSI Indicator

MT4 Free DownloadIntroduction to the Stochastic RSI Indicator

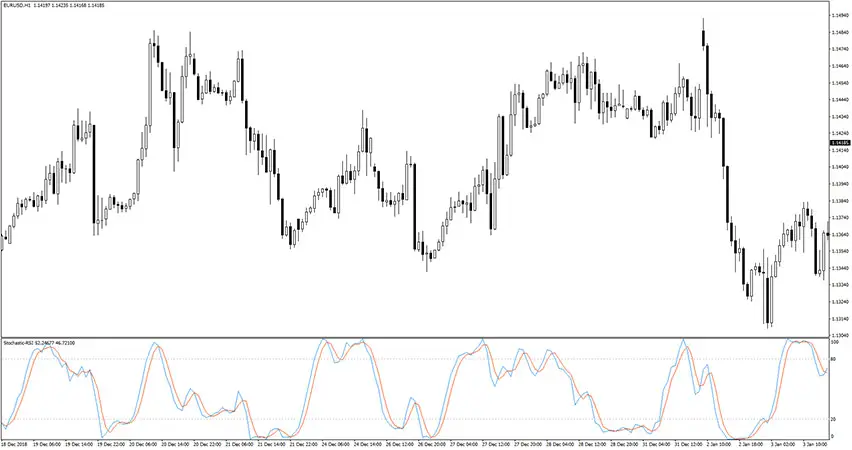

The Stochastic RSI Indicator (Stoch RSI) was developed to increase the sensitivity and reliability of the regular RSI indicator when it comes to trading off overbought/oversold RSI levels. In other words, it is used in forex technical analysis to provide a stochastic calculation to the RSI indicator. Of course, it is an oscillator and it calculates values between 0 and 100. That Stochastic RSI forex gauge simply provides better and more distinctive signals to trade upon.

The Stochastic RSI Indicator fits all kinds of timeframes and currency pairs. It is displayed in a separate window placed just below the main trading chart. The default settings can be modified directly from the input tab. Feel free to experiment with the settings and parameters to fit your personal preferences.

How does it work? How to apply in trading?

Trading Rules Explanation

As we explained earlier, the Stochastic RSI Indicator is a combination of RSI with Stochastic giving improved results. Notice, that unlike with traditional RSI, where we used 30 and 70 levels as oversold/overbought levels, here we use 20 and 80, same as for Stochastic indicator. Now, let’s take a look on how to use it.

Buy Signal

Follow these steps for a long trade:

- The overall trend should be bullish

- The Stoch RSI leaves oversold area (below 20)

- Buy trade is triggered after the above conditions are met

- Set stop loss a few pips below the last low point of the market

- Take profit or exit trade whenever the Stoch RSI reaches overbought level or use your own preffered method of trade exit

Sell Signal

Follow these steps for a short trade:

- The overall trend should be bearish

- The Stoch RSI leaves overbought area (above 80)

- Sell trade is triggered after the above conditions are met

- Set stop loss a few pips above the last high point of the market

- Take profit or exit trade whenever the Stoch RSI reaches oversold level or use your own preffered method of trade exit

As always, to achieve good results, remember about proper money management. To be a profitable trader you need to master discipline, emotions, and psychology. It is crucial to know when to trade, but also when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility conditions, beyond major sessions, exotic currency pairs, wider spread, etc.

How to set up the Stochastic RSI indicator in MT4?

Installation Guide

Download the Stochastic RSI.rar archive at the bottom of this post, unpack it, then copy and paste the Stochastic RSI.ex4 or Stochastic RSI.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Bottom Line

The Stochastic RSI indicator is well worth adding to your trading collection but remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time. Thus, this forex indicator provides false signals occasionally. Its performance will vary significantly depending on market conditions. Feel free to develop your own trading system based around it.

Stochastic RSI Indicator Free Download

To download the Stochastic RSI Indicator for Metatrader 4 (MT4) for free just click the button below:

Stochastic RSI Indicator Free Download