Zero Lag MACD Indicator

MT4 Oscillator TradingFree DownloadThe Zero Lag MACD Indicator for MetaTrader 4 is an interesting oscillator with no delay in provided signals. It’s best used for quick trend reversals in intraday trading as well as larger market swings when applied to higher timeframes charts. Its main advantage is minimal lag and it may be considered a golden mean between signal frequency and accuracy. Let’s have a closer look at it.

Classic MACD vs Zero Lag MACD

The classic MACD was created way back in 1979 and quickly gained recognition, especially among stock traders as it was praised for good effectiveness. While it was a nice fit for stock trading, the forex market proved to have more volatile nature.

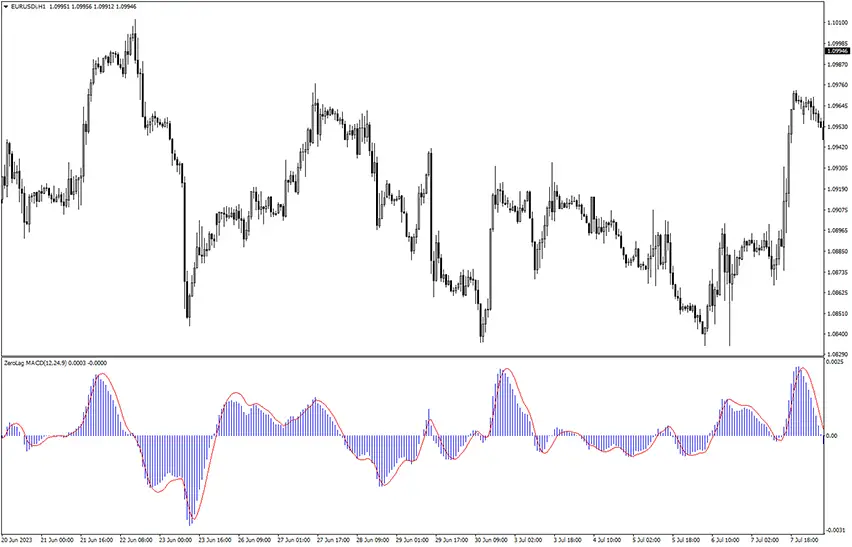

In contrast, the Zero Lag MACD was developed in 2010 and due to reacting to market changes in a much faster manner, it was simply called Zero-Lag MACD to better reflect its feature. Besides that non lag feature, it shows basic demonstration of market momentum through histogram bars. This is how the gauge looks like when you activate it.

How to apply Zero Lag MACD in trading?

As a matter of fact, the zero lag MACD can be used in:

- momentum trading

- reversal trading

- divergence trading

The formula behind this gauge involves three elements, namely 12-period EMA (fast), a 26-period EMA (slow), and a 9-period signal EMA. These three ingridients work together to calculate utilizable trading signals.

When it comes to momentum readings, it all depends on positivity or negativity of MACD values. Histogram bars above the zero level indicate a bullish momentum, and conversely, histogram bars located below that zero level suggest a bearish momentum.

As you can see it provides some basic signals, but the real art of speculation with help of this tool lies in divergence trading. Below you can find exact steps to follow both for long and short scenarios, however this approach should be rather utilized by knowledgable traders with a bit of experience.

Buy signal

- There should be a clear uptrend market

- Analyze zero lag MACD readings and spot its histogram bars to make higher low and lower low

- At the same time, price should make a noticable pullback

- Afterwards, confirm entry with bullish price action pattern (for example pin bar)

- Blue histogram bars should become smaller than red signal line

- Watch the price rise along with MACD values going to zero level or higher

Sell signal

- There should be a clear downtrend market

- Analyze zero lag MACD readings and spot its histogram bars to make lower higher and higher high

- At the same time, price should make a decent pullback

- Afterwards, confirm entry with bearish price action pattern

- Blue histogram bars should become smaller than red signal line

- Watch the price drop along with MACD values going to zero level or lower

Conclusion

While MACD is invariably one of the most popular technical analysis tools, this non lag version stands out as a great enhacement. It has better and quicker reaction to market fluctuations. It may be successfully utilized in various ways, like a foundation for a trend-momentum strategy or in a divergence trading techniques.

Free Download Forex Zero Lag MACD MT4 Indicator

To download the Zero Lag MACD Indicator for Metatrader 4 (MT4) for free just click the button below:

Zero Lag MACD Indicator Free Download