BT Trend Trigger Indicator

Platform: MT4 Type: Momentum Last update: September 15, 2024The BT Trend Trigger Indicator for MT4 serves as a helpful tool in detecting changing market trends. It can be considered a momentum gauge since these changes often happen very quickly. What’s more, forex traders looking to increase their success rate, may even use it as a confirmation for signals provided by other technical indicators. Let’s discover how you can benefit from it in more details.

Closer look at the BT Trend Trigger features

Main principles and the way it works

The BT Trend Trigger indicator analyses dynamics of market changes. It uses price data and volume in order to spot momentum shifts in their early stages. Once potential price reversal is in place, it provides corresponding signal. In the result, traders are equipped with a suggestion for opening a trade in more informed and knowledgeable manner.

The ability of fast detection of short-term reversals and momentum shifts makes this MT4 indicator a good choice for scalpers and day traders. Let’s see how it’s built and how to interpret the signals it generates.

The structure of this indicator

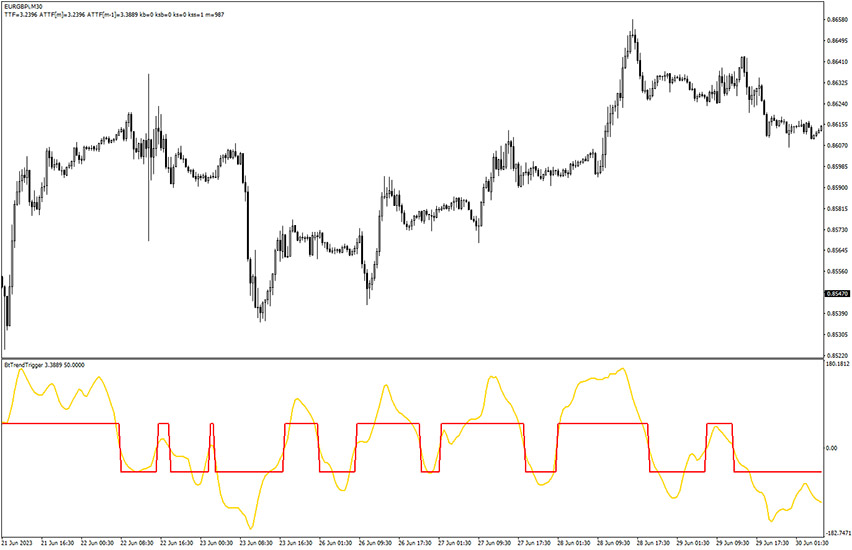

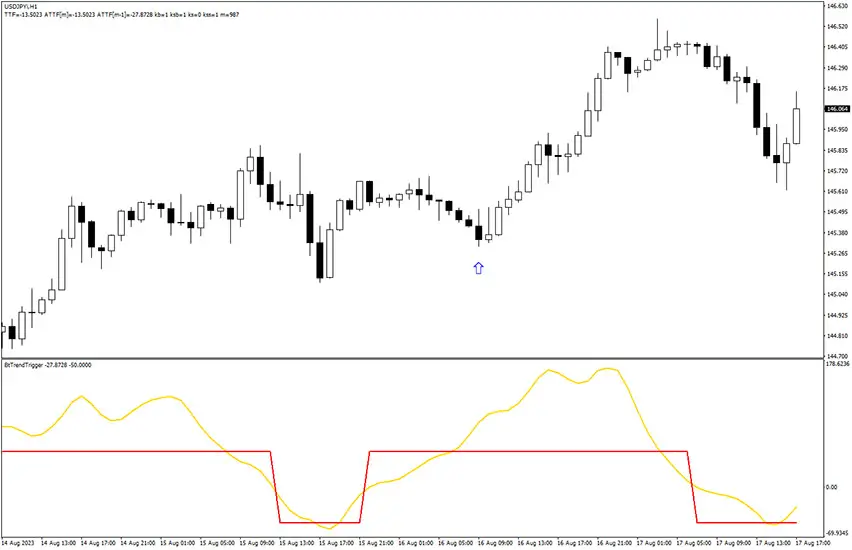

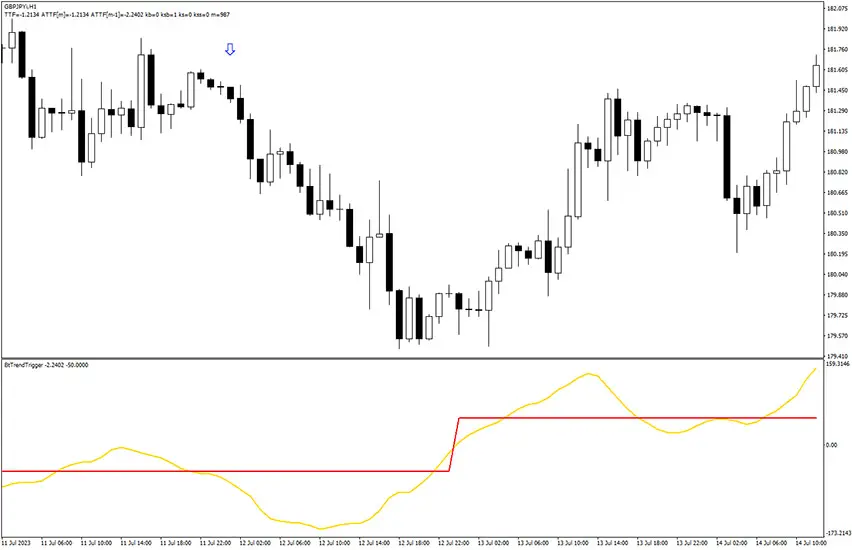

There are two main elements of the BT Trend Trigger: a trend direction module and a signal line. Here is their characteristics:

- Trend direction module – this is a thick red line. For most of the time it’s very flat, but positioned either to top or bottom.

- Signal line – this is a highly responsive yellow line. Pay attention to moments when it crosses the direction line.

How to trade with the provided signals?

First thing to note is that the BT Trend Trigger’s signals are based on crossover of the lines described just above. There are specifc setups for both bullish and bearish scenarios. The starting point is always to determine if the trend direction line is aligned above or below the 0 level.

Bullish signal

A valid long signal occurs when the trend direction line is positioned above the zero level (more to the top) and the yellow signal line crosses it from the bottom to the top.

Bearish signal

A valid short signal occurs when the trend direction module is positioned below the zero level (more to the bottom) and the yellow signal line crosses it from the top to the bottom.

…but when to exit?

While it’s pretty clear when to jump into the trade, it doesn’t really provide suggestions on when to ride a trade (when to exit). Although one may wait till the signal moves back into the red line but it tends to be a bit late event.

For that purpose, you can combine it with other indicator, ideally the one that show overbought/oversold price levels.

One of the ideas is to use BT Trend with RSI oscillator. Use standard approach for entering the trade, but exit when RSI line reaches overbought area for buy or oversold area for sell. Of course, you can use any exit strategy of your choice.

Summary

The BT Trend Trigger turns out to be a pretty universal indicator as it can be used both as a standalone trading tool and also can be applied to different strategies. It often provides high-probability signals and to get the most out of it a trader should account for price patterns analysis, market conditions, and psychological aspects like discipline.