Synthetic VIX Indicator MT5

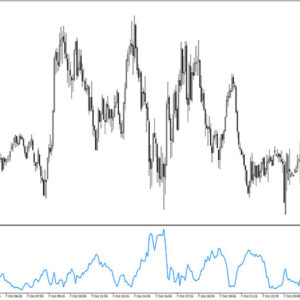

Platform: MT5 Type: Volatility Last update: October 18, 2025The Synthetic VIX Indicator for MT5 is responsible for evaluating market volatility and it tells traders if its increasing or decreasing over time. This is an oscillator so it displays its signals in a fluctuating waveform.

The data it provides is especially useful in low-liquidity and sideways markets, where most tools often struggle with noise and false signals.

Example chart:

How to use the synthetic vix indicator for mt5?

There are several effective ways to use the synthetic vix indicator.

General volatility measure

Primary purpose of this indicator is to measure market volatility, helping traders to determine whether the market is choppy or trending strongly. Higher readings indicate increased volatility, while lower readings suggest calmer, more stable markets.

Our suggestion is to interpret the signals in relation to price action to better understand the market trend and direction.

Volatility with breakout setup

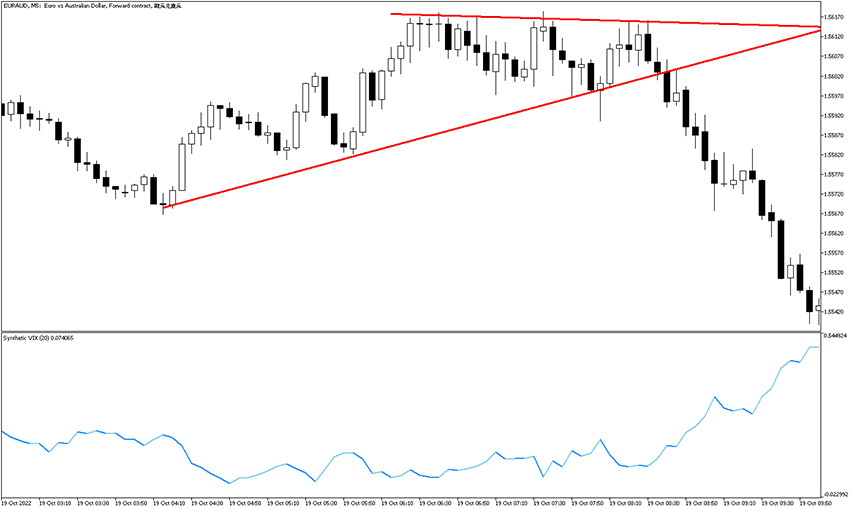

Another approach is to combine the indicator with breakout setups. Traders can manually identify consolidation patterns such as descending or ascending triangles, flags, wedges or rectangles.

When a price breakout occurs from one of these formations, a corresponding surge in the synthetic vix line can help confirm the validity of the move. This means that real volatility is entering the market and the breakout may have strong follow-through potential.

Take a look at this EUR/AUD M5 chart. It shows a breakout opportunity for a short position. Notice how the VIX reading rose as the price fell.

Additional notes

The best use case for this tool is validating market conditions before entering a position. Consider it rather as support, not a main signal provider.

Settings

In the settings tab, there is only one customizable option: “Synthetic VIX period” with default value of 20. This means that readings are calculated based on 20 previous bars and this value can be adjusted.

Submit your review | |