Turn Area Forex Indicator

MT4 Free DownloadIntroduction to the Turn Area Forex Indicator

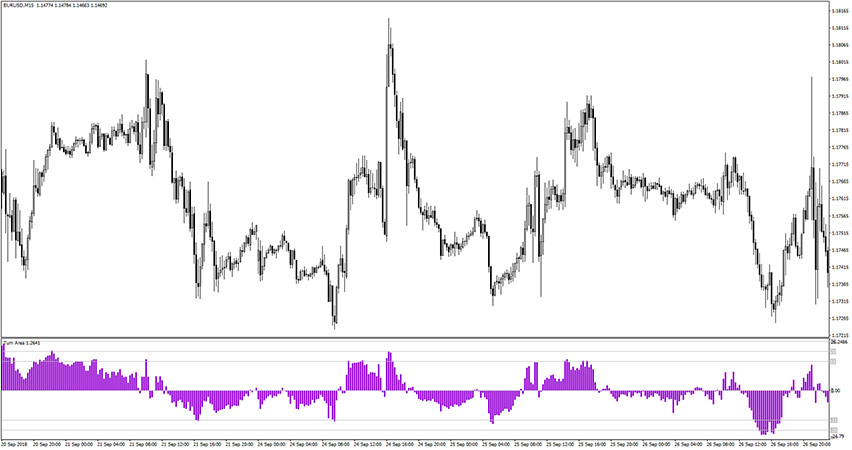

The Turn Area Forex Indicator is a combination of Relative Strength (RSI) and Exponential Moving Average (EMA). The signals are represented in a form of the histogram bars that can reach overbought/oversold levels (20/-20 respectively). Due to the nature of its signals, that forex indicator can be considered as a reversal indicator.

The Turn Area Forex Indicator fits all kinds of timeframes and currency pairs. It is displayed in a separate window placed just below the main trading chart. The default settings can be modified directly from the input tab. Feel free to experiment with the settings and parameters to fit your personal preferences.

How does it work? How to apply in trading?

Trading Rules Explanation

As we mentioned earlier, the Turn Area Forex Indicator uses a 12-day EMA along with a 21-period of RSI for determining both the market trend and its overbought or oversold conditions. Positive values mean the trend is bullish, and conversely, negative values reflect the bearish trend. Detailed trading instructions are provided below.

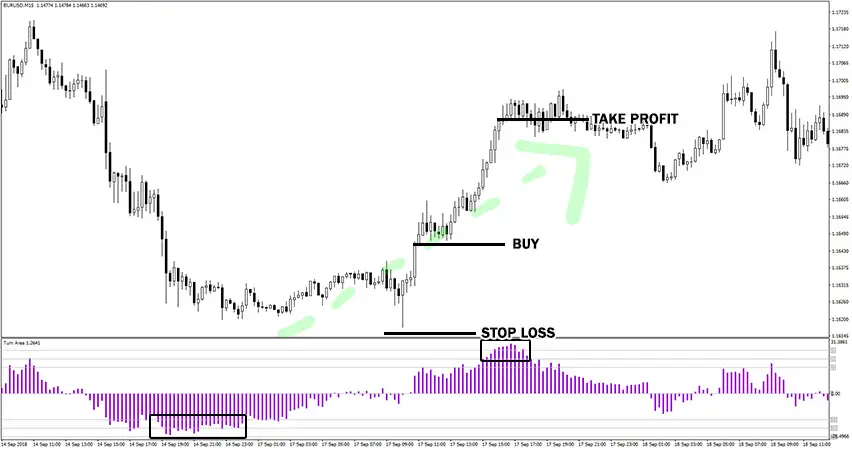

Buy Signal

Follow these steps for a long trade:

- Turn Area Indicator bars drops below oversold level (-20 level) and then reverse above 0 level

- Price swings higher from recent low swing

- Buy trade is triggered after the above conditions are met

- Set stop loss a few pips below the last swing low of the market

- Take profit or exit trade whenever the Turn Area indicator bars stars to drop from its overbought level

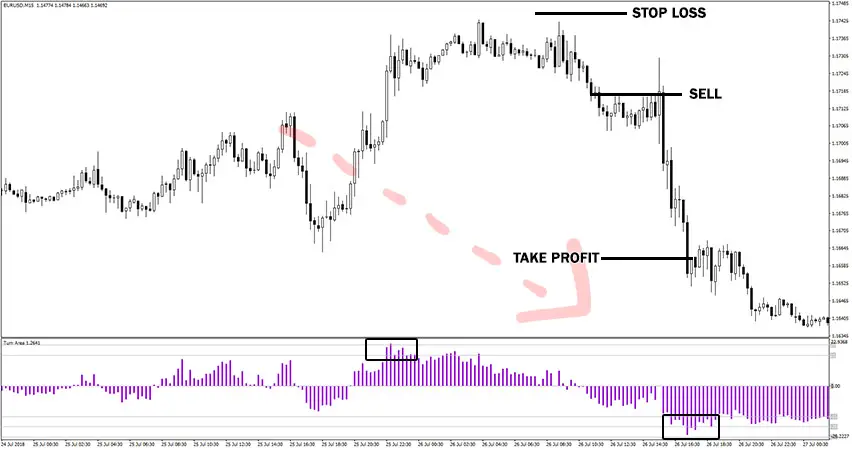

Sell Signal

Follow these steps for a short trade:

- Turn Area Indicator bars rises above ovebought level (20 level) and then reverse below 0 level

- Price swings lower from recent high swing

- Sell trade is triggered after the above conditions are met

- Set stop loss a few pips above the last swing high of the market

- Take profit or exit trade whenever the Turn Area indicator bars stars to rise from its oversold level

As always, to achieve good results, remember about proper money management. To be a profitable trader you need to master discipline, emotions, and psychology. It is crucial to know when to trade, but also when not to trade. Avoid trading during unfavorable times and market conditions like low volume/volatility conditions, beyond major sessions, exotic currency pairs, wider spread, etc.

How to set up the Turn Area Forex indicator in MT4?

Installation Guide

Download the Turn Area Forex.rar archive at the bottom of this post, unpack it, then copy and paste the Turn Area Forex.ex4 or Turn Area Forex.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Bottom Line

The Turn Area Forex indicator is well worth adding to your trading collection. A good forex indicator will most probably enhance your chance of success. Nonetheless, remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time. Thus, this forex indicator provides false signals occasionally. Its performance will vary significantly depending on market conditions. Feel free to develop your own trading system based around it. Don’t forget that we still have more great free forex MT4 indicators to download and try.

Download Free MT4 Turn Area Forex Indicator

To download the Turn Area Forex Indicator for Metatrader 4 (MT4) for free just click the button below:

Turn Area Forex Indicator Free Download