Fibonacci Pivots Indicator MT4

MT4 Free DownloadThe Fibonacci Pivots Indicator for MT4 places the classic values of Fibo extensions directly on the forex trading chart and it’s available to free download.

Sounds interesting? Let’s take a closer look at it and bring some practical trading examples.

Introducing the Fibonacci Pivots Indicator

MT4 Indicator Overview

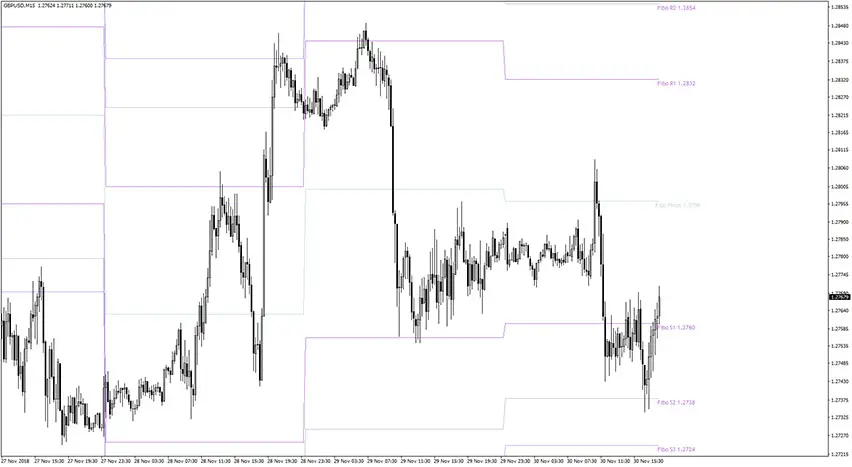

The download link of the Fibonacci Pivots MT4 indicator is placed at the bottom of this post. Once you’re done, your trading chart should look similar to the example below.

New and experienced traders should know the importance of locating the optimal support and resistance levels. Pivot levels are commonly utilized by forex traders to determine the prevailing price trends.

By combining pivot levels with Fibonacci ratios, traders can identify robust support and resistance levels. The Fibonacci Pivots indicator is a tool that provides stop loss and multiple take profit points. This feature enables traders to track the markets once the trend has been established.

Using Fibonacci Pivots Indicator to Find Support and Resistance Levels in Forex Trading

At the beginning of each trading day, traders often focus on identifying support and resistance levels, using additional indicators to validate them. However, with the Fibonacci pivot level indicator for MT4, traders can automatically locate the most optimal support and resistance levels.

Another critical task is determining the potential trend for the day. Pivot points are calculated using the previous day’s high, low, and closing prices and dividing by three. If prices are below the previous day’s pivot level, the trend is considered bearish. Intraday traders typically look for bullish price action if the current price remains above the pivot level.

Fibonacci numbers are highly valued by traders, regardless of their experience level, for their effectiveness in forex trading. Traders apply Fibonacci numbers to the pivot point to derive the best support and resistance levels. Additionally, traders use Fibonacci ratios of 38.2, 61.8, and 76.4 to calculate three distinct resistance and support levels.

How to set up the Fibonacci Pivots indicator in MetaTrader (MT4)?

Forex Indicator Installation And Download

Download the fibonacci-pivots.rar archive at the bottom of this post, unpack it, then copy and paste the fibonacci-pivots.ex4 or fibonacci-pivots.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Conclusion

The calculation of pivots relies on the previous day’s data, but the market can behave differently, and the indicated trend may not always hold. Fibonacci numbers are used to derive support and resistance levels, which are based on mathematical values. While both indicators add strength to support and resistance levels, successful trading requires additional confirmation using price action. It can be a great addition to any forex trading strategy.

Download Free Forex Fibonacci Pivots MT4 Indicator

To download the Fibonacci Pivots Indicator for Metatrader 4 (MT4) for free just click the button below:

Fibonacci Pivots Indicator Free Download