Half Trend Buy Sell Indicator

MT4 Free DownloadIntroduction to the Half Trend Buy Sell Indicator

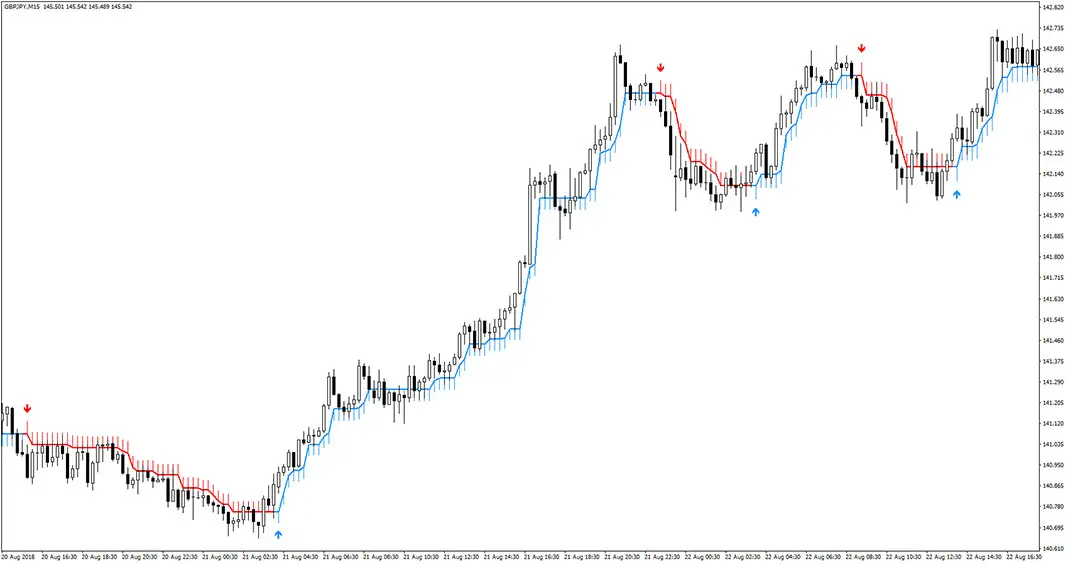

The Half Trend Buy Sell Indicator is a popular indicator and it is widely used in many forex systems and trading strategies. It works very well at determining past and current bear and bull trends.

This tool falls into the trend-following category of indicators.

It consists of two elements: the main signal line plus buy / sell arrows. The indicator is easy to use and fits all kinds of timeframes and currency pairs.

The default indicator settings can be modified directly from the input tab. Feel free to experiment with the settings and parameters to fit your personal preferences.

How does it work? How to apply in trading?

Trading Rules Explanation

Buy Entry: Open long trade when the indicator signal line turns blue and the upward arrow occurs. Place your stop loss a few pips below last swing low and trail it up with the moves of the signal line.

Sell Entry: Open short trade when the indicator signal line turns red and the downward arrow occurs. Place your stop loss a few pips above last swing high and trail it down with the moves of the signal line.

Exit Trade / Take Profit: Close your open position when an opposite signal occurs, or use your own preferred method of trade exit.

As always, to achieve good results, remember about proper money management. To be a profitable trader you need to master discipline, emotions, and psychology.

Example of EUR/USD H4 Chart

This screenshot below shows an example of Half Trend Buy Sell forex indicator in action.

See also:

Buy Sell Arrow Indicator Non Repaint

100% Non Repaint Forex Scalping Indicator

Sidus Indicator

Auto Trendline Indicator MT4

How to set up the Half Trend Buy Sell indicator in MT4?

Installation Guide

Download the Half Trend Buy Sell.rar archive at the bottom of this post, unpack it, then copy and paste the Half Trend Buy Sell.ex4 or Half Trend Buy Sell.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Bottom Line

The Half Trend Buy SellNo Repaint indicator is well worth adding to your trading collection. A good forex indicator will most probably enhance your chance of success. Nonetheless, remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time. Thus, this forex indicator provides false signals occasionally. Its performance will vary significantly depending on market conditions. Feel free to develop your own trading system based around it.

Download Free Forex MT4 Half Trend Buy Sell Indicator

To download the Half Trend Buy Sell Indicator for Metatrader 4 (MT4) for free just click the button below:

Half Trend Buy Sell Indicator Free Download