RSI Divergence Indicator MT4

MT4 Free DownloadIntroduction to the RSI Divergence Indicator

The RSI Divergence Indicator is a forex technical indicator for MT4 that shows a divergence between price and the Relative Strength Indicator.

The classical RSI indicator is an oscillator that signals the two extremes of the market: oversold and overbought levels. Using the classic 14-period RSI, the sell signal occurs when the RSI line exceeds 70, while a buy signal occurs when the indicator’s value is below 30.

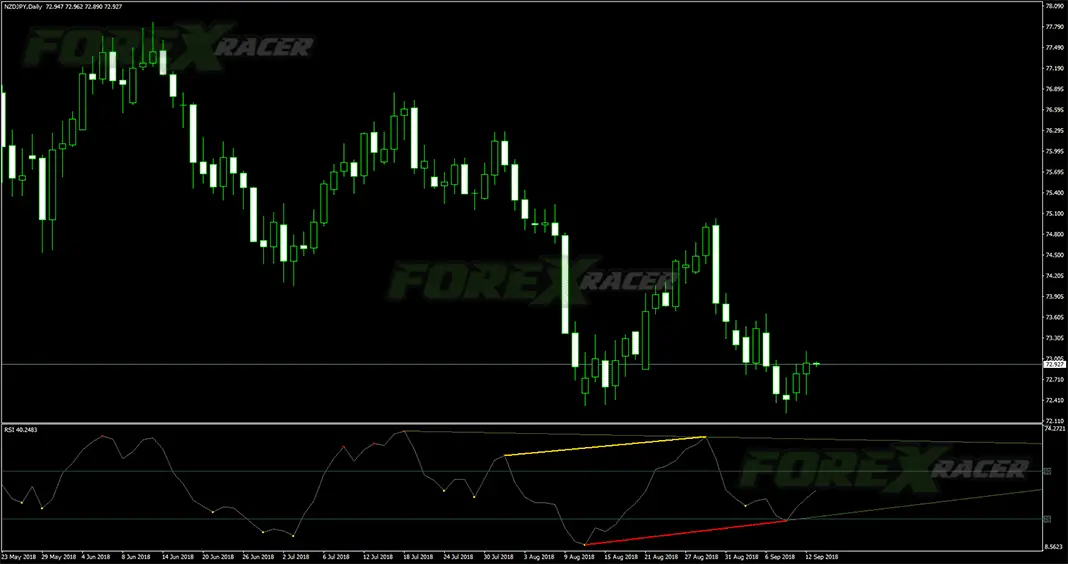

Divergence is a disagreement between the price action and the oscillator. You can notice this pattern when the lower lows (in a downtrend) or higher highs (in an uptrend) of the price chart differs from the peaks and troughs of the oscillating RSI indicator.

Divergences are usually used for finding and trading market trend reversals. That is a very powerful price action forex strategy.

In a few simple words, during uptrend divergence between price action and RSI happens when the price of a currency pair makes higher highs but the RSI indicator does not, and alternatively, during downtrend divergence between price and RSI happens when the price of a currency pair makes lower lows but the RSI indicator does not.

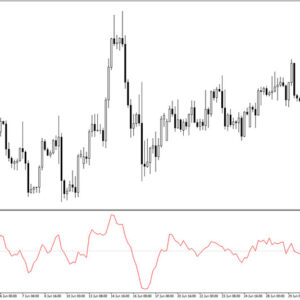

The RSI Divergence MT4 Indicator is displayed in a separate trading window below the main trading chart. The red and yellow lines indicate a divergence between price and RSI.

Check also: MACD Divergence and Knoxville Divergence

How to trade with the RSI Divergence Indicator?

Trading signals of the RSI Divergence forex indicator are easy to follow and you can find them below.

Bullish divergence

Open BUY trade when the following conditions are met:

- There is a downtrend.

- The price action of your currency pair makes lower lows but the RSI divergence indicator does not.

- The RSI Divergence Indicator draws a divergance line.

- That is an early signal of a trend reversal. You can go long after closed candle.

- Optionally, you can confirm the buy trade with the help of other technical tools.

- Take profit or exit the trade at the arrival of the opposite signal.

Bearish divergence

Open SELL trade when the following conditions are met:

- There is an uptrend.

- The price action of your currency pair makes higher highs but the RSI divergence indicator does not.

- The RSI Divergence Indicator draws a divergance line.

- That is an early signal of a trend reversal. You can go short after closed candle.

- Optionally, you can confirm the sell trade with the help of other technical tools.

- Take profit or exit the trade at the arrival of the opposite signal.

How to set up the RSI Divergence indicator in MT4?

Installation Guide

Copy and paste the rsi-divergence-indicator.ex4 or rsi-divergence-indicator.mq4 indicator files into the MQL4 folder of the Metatrader 4 trading platform.

You can gain access to this folder by clicking the top menu options, that goes as follows:

File > Open Data Folder > MQL4 > Indicators (paste here).

Now go to the left side of your MT4 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Bottom Line

The RSI Divergence indicator is well worth adding to your trading collection but remember about having realistic expectations. Just like any other technical analysis tool, is not capable of providing accurate signals 100% of the time. Thus, it will provide false signals occasionally. Its performance will vary significantly depending on market conditions. Feel free to develop your own trading system based around it.

RSI Divergence Indicator Free Download

To download the RSI Divergence Indicator for Metatrader 4 (MT4) for free just click the button below:

RSI Divergence Indicator Free Download