Simple ZZ Consolidation Zones Indicator MT5

MT5 Free DownloadThe Simple ZZ Consolidation Zones Indicator MT5 is a technical indicator created with the aim of assisting traders in swiftly identifying compact market consolidation zones. These consolidation phases offer abundant trading opportunities to knowledgeable traders who can effectively identify consolidations and the indicator serves as a valuable tool in recognizing these favorable conditions. Free download is available.

Sounds interesting? Let’s take a closer look at it.

Simple ZZ Consolidation Zones Indicator: Introduction

MT5 Indicator Overview

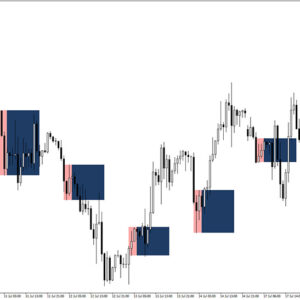

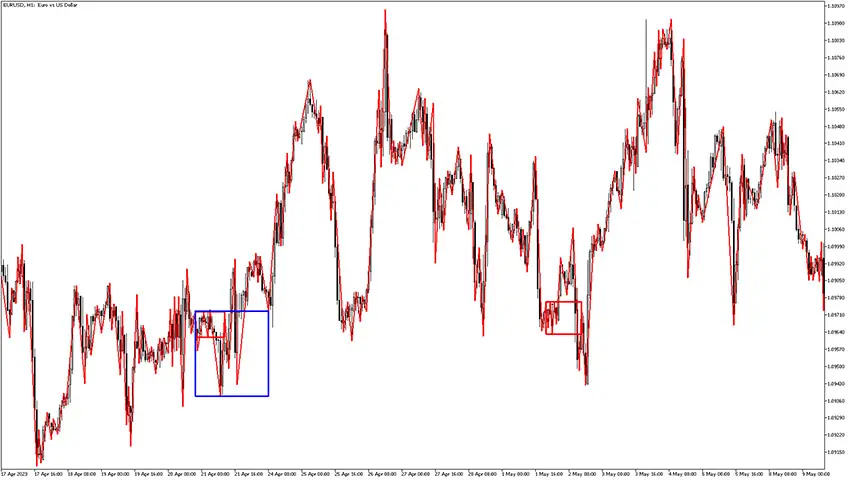

The download link of the Simple ZZ Consolidation Zones MT5 indicator is placed at the bottom of this post – once you’re done, your Metatrader 5 trading chart should look similar to the example below.

The Simple ZigZag Consolidation indicator is an innovative approach to automating the visualization of technical analysis. It incorporates a simple zigzag pattern that marks local highs and lows on a chart. Furthermore, the indicator scans the price chart for flat consolidation zones and highlights these areas with colored blue and red rectangles to facilitate easy identification.

Consolidation Areas Explained

One of the most frequently observed patterns in a tradable market is the alternating sequence of market expansion and market consolidation phases. The consolidation seems like the market participants seek a momentary pause to capitalize on their successful positions before another robust market surge unfolds.

Buy Signal Setup

To identify a tight market consolidation zone, look for the most recent bullish momentum pulse during a market expansion phase, and initiate a buy order immediately when a bullish momentum candle surpasses the market consolidation zone. Place the stop loss below the entry candle’s support level.

Sell Signal Setup

To identify a tight market consolidation zone, observe the most recent bearish momentum drop during a market expansion phase, and initiate a sell order promptly when a bearish momentum candle breaches the market consolidation zone. Place the stop loss above the entry candle’s resistance level.

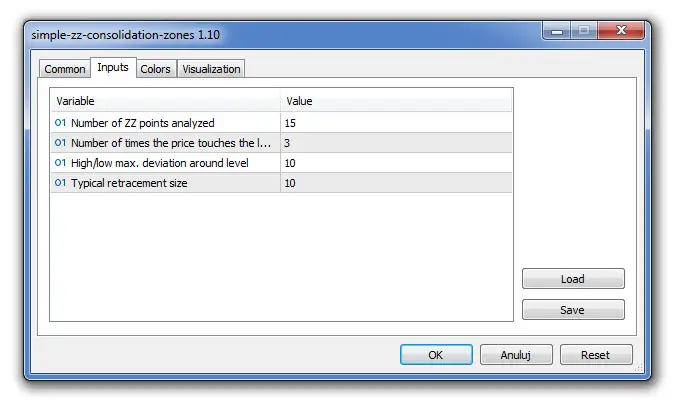

Settings

The indicator utilizes three parameters to determine the construction of a zone: the number of highs/lows needed, the total number of analyzed zigzag points, and the accuracy of matching extrema. These parameters are defined as follows:

- Number of times the price touches the level.

- Number of ZigZag points analyzed.

- Maximum deviation of high/low around the level.

Additionally, the indicator inherits a fourth parameter, known as Typical retracement size, from its parent indicator.

MT5 Indicators: Download and Installation Instructions

Download the Simple ZZ Consolidation Zones Indicator MT5.rar archive at the bottom of this post, unpack it, then copy and paste the simple-zz-consolidation-zones.ex5 or simple-zz-consolidation-zones.mq5 indicator files into the MQL5 folder of the Metatrader 5 trading platform.

You can gain access to this folder by clicking the top menu options, which goes as follows:

File > Open Data Folder > MQL5 > Indicators (paste here).

Now go to the left side of your MT5 terminal. In the Navigator find the gauge name, right-click it and select Attach to the chart.

Indicator Summary

The MT5 Simple ZZ Consolidation Zones indicator for MetaTrader serves as a helpful tool for identifying tight market consolidation phases, however, the responsibility still lies with the trader to visually confirm and determine the presence of such a consolidation phase. The momentum breakouts discussed here typically indicate momentum continuation, suggesting that after a previous rally and a market consolidation, another rally is anticipated. Similarly, after a prior drop and a market consolidation, another drop is expected. Nevertheless, there are instances where the market reverses immediately after a consolidation phase. Consequently, market consolidation phases can also be traded as potential reversals.

Download Free Forex Simple ZZ Consolidation Zones MT5 Indicator

To download the Simple ZZ Consolidation Zones Indicator for Metatrader 5 (MT5) for free just click the button below:

Simple ZZ Consolidation Zones Indicator Free Download